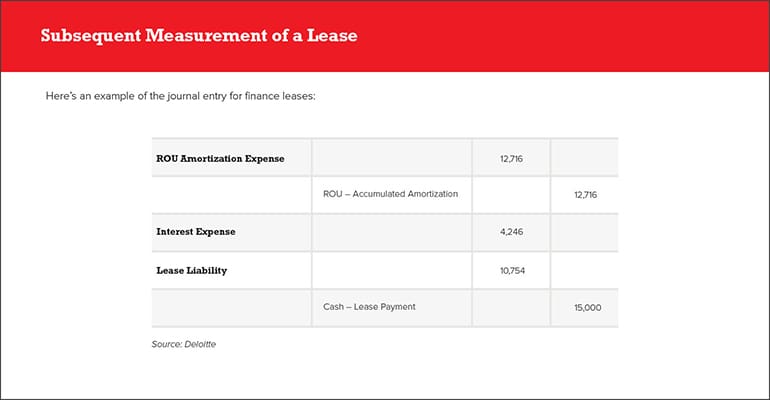

IFRS 16 Leases. IFRS 16 Leases The $3 trillion standard “One of my great ambitions before I die is to fly in an aircraft that is on an airline's balance. - ppt download

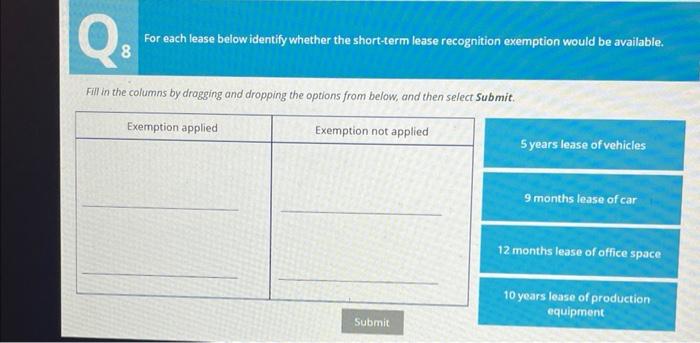

CA Final | FR | Ind AS 116 | Lessee Accounting - Exemptions | Short Term & Low Value Leases - YouTube

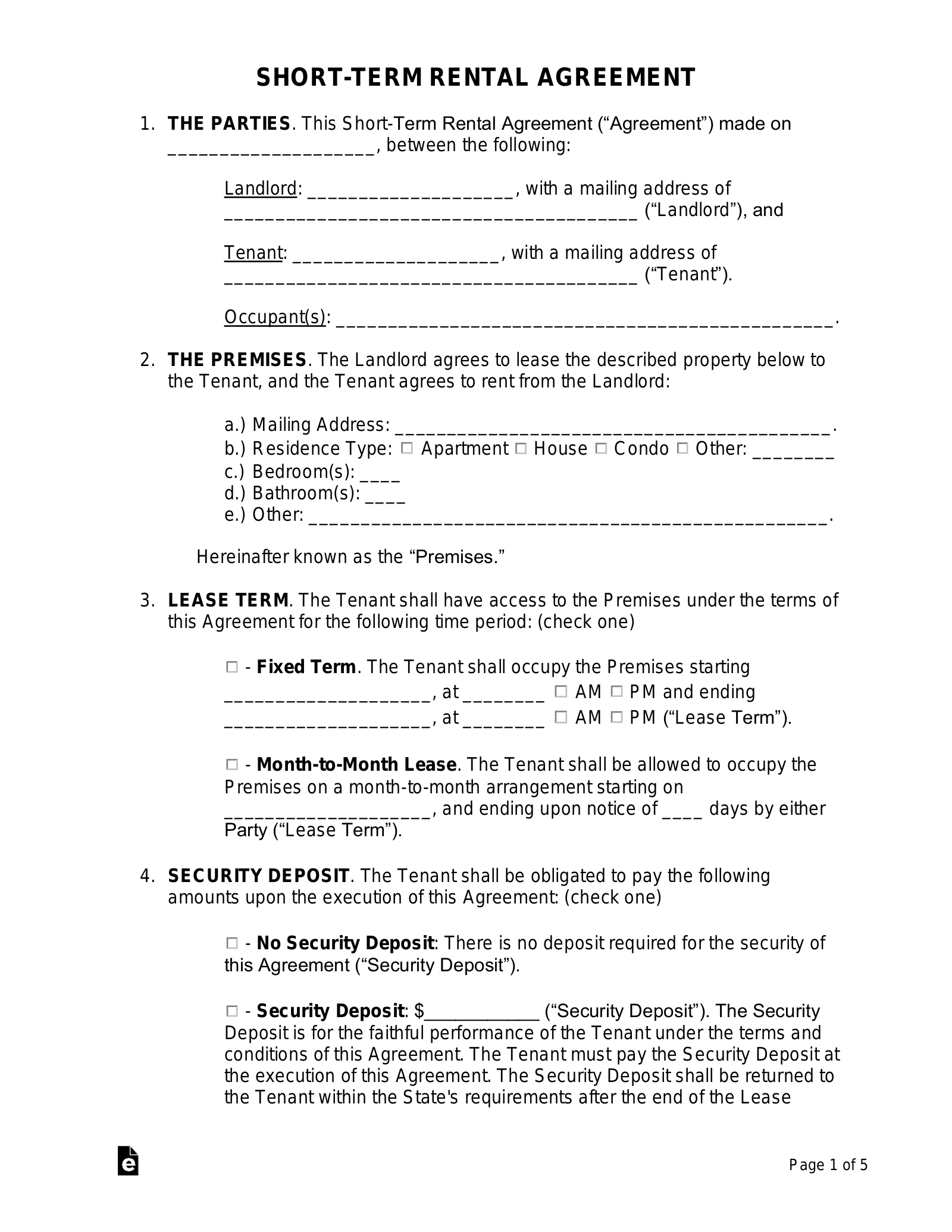

![Short-Term (Vacation) Rental Agreement [Word & PDF] Short-Term (Vacation) Rental Agreement [Word & PDF]](https://legaltemplates.net/wp-content/uploads/short-term-lease-agreement-2023.png)

![Short-Term (Vacation) Rental Agreement [Word & PDF] Short-Term (Vacation) Rental Agreement [Word & PDF]](https://legaltemplates.net/wp-content/uploads/property-1024x582.png)

![What Is The Short-Term Lease Exemption Under IFRS 16 [With Example] | IRIS What Is The Short-Term Lease Exemption Under IFRS 16 [With Example] | IRIS](https://cdn2.hubspot.net/hubfs/382727/What%20Is%20The%20IFRS%2016%20Exemption%20For%20Short-Term%20Leases%20%5BWith%20IFRS%2016%20Example%5D.png)